¿Qué hacemos

Llevamos más de 50 años desarrollando competitivamente y gestionando infraestructuras de transporte

Trabajamos para aportar el máximo valor en todos nuestros proyectos gestionando todas las fases del ciclo de vida de un activo de forma eficiente.

Sala de prensa

Últimas noticias

Ferrovial obtiene la certificación SGE 21 de Forética gracias a su gestión ética y socialmente responsable

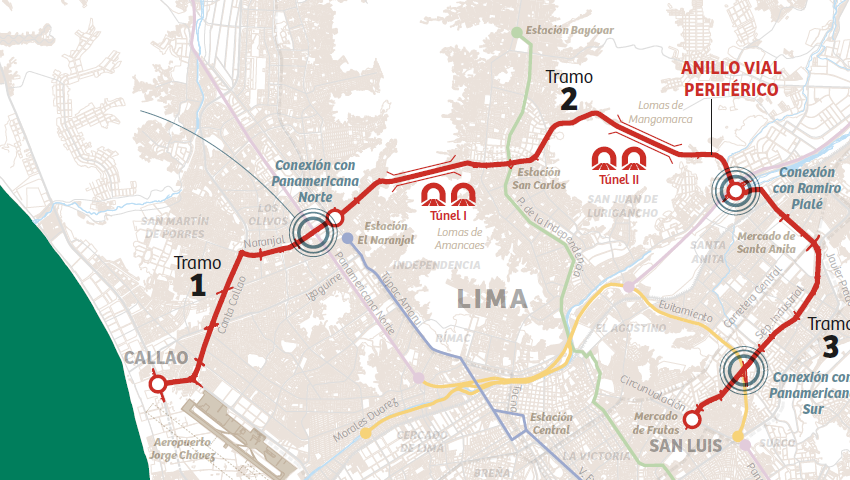

Ferrovial, Acciona y Sacyr desarrollarán el Anillo Vial Periférico de Lima por una inversión de 3.400 millones de dólares

Ferrovial acuerda la adquisición de un 24% en IRB Infrastructure Trust por 740 millones de euros

Ferrovial mejora su Resultado Bruto de Explotación un 34,1% a cierre de septiembre

Ferrovial cierra una financiación de 400 millones de dólares para la mejora de la autopista NTE en Texas

Proyectos

Nuestras autopistas por el mundo

Conoce todas las autopistas

Autopista 407 ETR

Autopista LBJ en Dallas, Texas, EEUU

Autopista North Tarrant Express

Autovía de la Plata A-66

Autopista Autema

Serranopark

Sostenibilidad

Creamos valor para la sociedad

1262km y presencia en 9 países

United States

Conoce cómo trabajamos en EE.UU.

- 5 Managed Lanes

- 9.066 M€ Inversión Total Gestionada

- 148 km Gestionados

- 47% Inversión en EE.UU.

Canadá

Conoce cómo trabajamos en Canadá

- 3 Activos

- 4.095 M€ Inversión Total Gestionada

- 175 km Gestionados

- 21,2% Inversión en Canadá

Colombia

Conoce cómo trabajamos en Colombia

- 1 Activo

- 695 M€ Inversión Total Gestionada

- 152 km Gestionados

España

Conoce cómo trabajamos en España

- 5 Activos

- 1.180,2 M€ Inversión Total Gestionada

- 202,3 km Gestionados

- 7,3% Inversión en España

Australia

Conoce cómo trabajamos en Australia

- 2 Activos

- 1.139 M€ Inversión Total Gestionada

- 281 km Gestionados

- 6% Inversión en Australia

Portugal

Conoce cómo trabajamos en Portugal

- 4 Activos

- 1.008 M€ Inversión Total Gestionada

- 342,5 km Gestionados

- 6,3% Inversión en Portugal

Eslovaquia

Conoce cómo trabajamos en Eslovaquia

- 1 Activo

- 904,5 M€ Inversión Total Gestionada

- 59,1 km Gestionados

United Kingdom

Conoce cómo trabajamos en Reino Unido

- 1 activo

- 1.770,9 M€ Inversión Total Gestionada

- 30 km Gestionados

Irlanda

Conoce cómo trabajamos en Irlanda

- 2 Activos

- 884 M€ Inversión Total Gestionada

- 84 km Gestionados

Innovación

A la vanguardia en la operación e implementación de la última tecnología

Cifras más destacas de Cintra en 2023

-

Inversión gestionada

21906M€ -

10 países

21concesiones -

1169Km gestionados

-

704M€Dividendos